WHAT TO BRING WITH YOU TO YOUR APPOINTMENT:

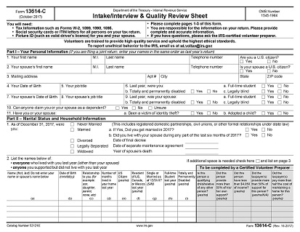

To speed up your tax preparation process, please download the following form, fill out pages 1-3, then print out and bring the completed form with you to your appointment. (If you do not have a printer or if you have any questions about the form, please contact us at [email protected] ) You must also bring the other items listed below.

- Picture ID for yourself and spouse (if any)

- Original Social Security Card for yourself, spouse (if any), and every person being claimed as a dependent on your tax return. If you do not have the originals of any required social security card, you must bring another document (other than a W-2 form) that shows the person’s social security number. Birth certificates are not acceptable – they do not contain social security numbers. A copy of your previous year’s tax return can be used if that return lists all of the same people and was prepared professionally or with the use of tax software or by one of our free sites (NOT by hand)

- All documents and information listed below if they apply to you:

- Copy of last year’s tax returns if possible

- All W-2 Forms showing wages

- If you are self-employed, you must be a sole proprietor and all receipts and expenses MUST BE ORGANIZED INTO CATEGORIES AND CALCULATED BY YOU – You must also have a General Excise Tax License and a record of general excise tax payments made during the year.

- Unemployment Compensation Statements (1099 G);

- SSA-1099 Form if you were paid Social Security benefits;

- All other 1099 Forms showing other income such as interest earned, dividends, independent contractor earnings, and pensions FOR EXAMPLE:

- 1099-INT

- 1099-DIV

- 1099-MISC (independent contractors)

- 1099-R (pension or annuities)

- 1099-C (cancellation of debt – but ONLY if the cancellation results from a personal credit debt or the foreclosure of a primary residence)

- Landlord’s name, address, and General Excise Tax number if you are claiming the Low Income Renters Credit.

- Student Loans, Scholarship and Tuition fees – including any 1098-T Forms issued to you by the college or university PLUS a print out of your educational account which students can access through their college account.

- Alimony paid or received.

- All forms indicating other Federal tax payments such as estimated tax payments, etc.

- All forms indicating IRA contributions

- Child or Dependent Care Provider information (name, employer ID or social security number of person providing care, an invoice for amounts paid to the provider)

- Bank information if you are direct depositing your refund – must be in your name

- PROOF OF HEALTH INSURANCE COVERAGE. Everyone must show proof of health insurance coverage for all of 2017 or establish that they are exempt. Taxpayers who claim a dependent are responsible for that dependent’s coverage. Please bring with you any 1095 forms you might have received. If you received a 1095-A Form you MUST bring that with you even if you had no income for the year

We DO NOT prepare the following types of returns or forms (considered out-of-scope for VITA):

- Returns for those receiving rental income (landlords)

- Partnership or corporate returns

- Returns with farm or fishing income

- Schedule C (business) with losses or employees or inventory or any claim for actual vehicle expenses (vs. standard mileage rate) or expenses over $25,000

- Complicated and advanced Schedule D (capital gains and losses)

- Returns for taxpayers who are in the U.S. on an F, J, M, or Q visa.

- Self-employed health coverage deductions for the premium tax credit

- Returns involving alimony/divorce agreements executed before 1985

- Tax returns for ministers and members of the clergy because of unique tax issues

- Form W-2 with code Q in box 12, indicating combat pay – Military certification required; only certain sites have volunteers certified for Military returns – contact us

- Energy credits – Form 5695 Part 1 (out-of-scope)

- Form SS-5 (request for Social Security Number)

- Form 8606 (non-deductible IRA)

- Form 8615 (minor’s investment income)

- Form SS-8 (determination of worker status for purposes of federal employment taxes and income tax withholding)

- Certain types of pensions and annuity payments if taxable amounts are not calculated

- Those with income from another state unless that state collects no income taxes

IF YOUR RETURN IS OUT-OF-SCOPE FOR VITA and if you are comfortable preparing your own return and you earned less than $66,000 in 2018, please go to http://myfreetaxes.com. This site will allow you to prepare AND e-file BOTH your federal and state returns for FREE as long as your income does not exceed $66,000. This free service is provided by United Way Worldwide.